Procurement/purchasing professionals no doubt deal with a variety of suppliers and purchasing strategies. 30 years ago a new approach was introduced by Peter Kraljic. His model, the Kraljic Portfolio Purchasing Model, seeks to gain better control over the entire range of purchased items, to some extent regardless of the annual spend associated with each. If you have experience with the Kraljic Portfolio Purchasing Model, we would be particularly interested to learn of your experiences and evaluation of this tool, please leave your comments below.

Apparently Pareto’s Law was the guiding principle for purchasing prior to Kraljic. An ABC analysis is one such technique, which focuses management attention on those items consuming the most dollars. Kraljic taught that purchasing needed to become more strategic than just looking at spending. Opportunities for great gain may lie in dealing effectively with relatively low dollar suppliers who may have other factors of great significance—such as scarcity. It also protects against supply disasters if an important, but perhaps low cost item, does not receive attention before becoming a crisis.

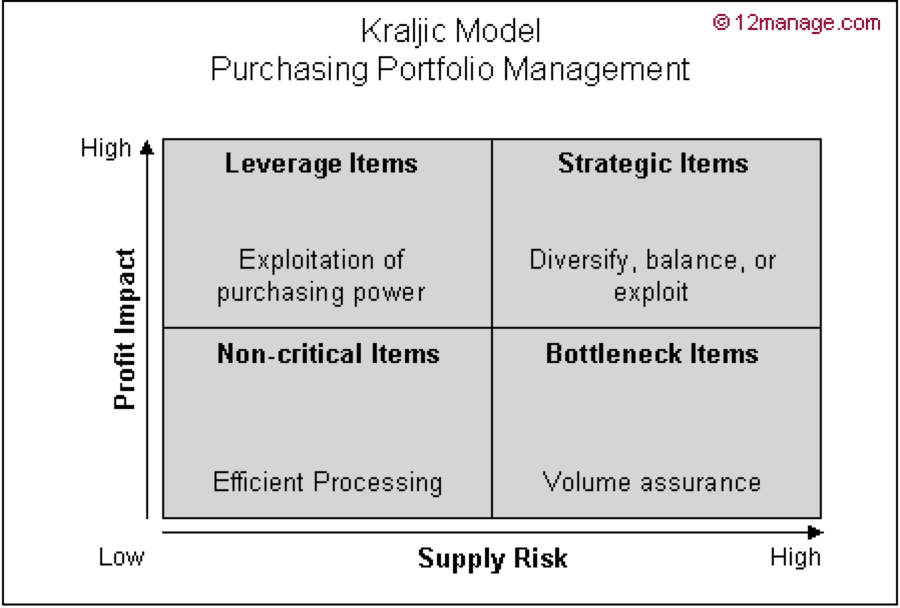

The Kraljic Model analyzes a company’s entire purchasing portfolio in order to devise appropriate strategies for each category. Each item in the portfolio is assigned to one of 4 categories in terms of supply risk and profit impact. The portfolio model, developed for equity investments in the 1950’s, was adapted to purchasing by Kraljic’s landmark work.

As opposed to simply categorizing items according to cost, overall consumption value, or annual spend, the Kraljic model’s first step is to classify all purchases according to supply risk and profit impact. Each item is categorized according to whether it is high or low for each of those two factors.

Supply risk is high when the item or service is scarce or difficult to acquire due to distance, geography, or political issues. The item might entail supply risk if it is difficult to switch suppliers, or if the availability of substitute products is limited. Conversely, a low risk item would be some commodity, widely available from many suppliers. This factor does not consider price.

Profit Impact is high when the item adds significant value to the finished product. It can also be volume or value purchased, impact on supply chain value added, business growth potential or dependency.

Items to be analyzed are assigned to one of four quadrants in the Kraljic product purchasing classification matrix.

This placement assigns items to a particular quadrant of the matrix, and a specific approach toward supplier management is suggested for each quadrant.

Naturally, each company might have a supplier philosophy that would generate great differences in how to manage suppliers, so the Kraljic Model does not specify the exact strategic points to use. This is left to each user of the model. The general idea of Kraljic’s model is to minimize supply risk and make the most of buying power.

The “leverage” items, where profit impact is high and supply risk low, allow the buying company to exploit its full purchasing power through such strategies as target pricing or product substitution. As the supply risk increases, Kraljic would recommend a more collaborative approach with suppliers and especially in the strategic item quadrant.

This article is a very brief explanation of the Kraljic Purchasing Portfolio Model. If the comparison to a Pareto based purchasing program is of interest, you can view a brief You Tube that shows how Kraljic expands upon the Pareto approach: https://www.youtube.com/watch?v=GKWHdc7LlnU.